However, this onsite service comes at a higher cost due to salaries, benefits, and office space considerations. Managing client trust accounts demands careful attention to detail and strict adherence to regulations. Every business expense incurred by the firm, whether it’s office supplies, travel costs, court filing fees, or continuing education expenses, must be documented with receipts. These transaction records are required for tax purposes and to ensure transparency in billing clients. Law firms must maintain specific documentation related to their operations and ethical responsibilities.

With multiple systems and applications to integrate, legal billing, accounting and payment processing can be a major headache. Our legal management software brings clarity to complex processes with simple, customizable rate cards, time entries, invoices and more. AZL’s process promotes inclusive financial reporting by standardising financial procedures for all staff. This means ensuring both finance teams agree on what constitutes WIP, how to value partner Drawings, and how to treat accruals. Establish trust accounting rules and ensure everyone in the firm follows them. Outsourcing also brings the advantage of scalable services, adapting to the firm’s changing needs.

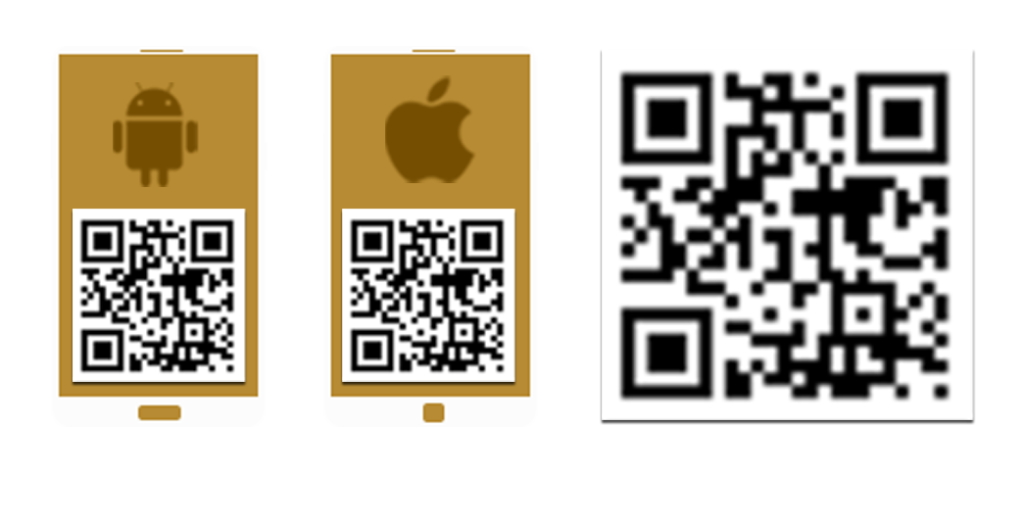

Once you’ve determined what kinds of payments your firm will accept, you’ll then need to choose a payment provider to work with. A critical part of the accounting process focuses on analyzing financial reports and KPIs for your law firm to uncover critical insights and make informed business decisions. The following best practices outline essential law firm accounting procedures that every attorney should understand and apply.

The following records ensure transparency and regulatory compliance and help foster client trust. Reconcile bank statements and trust account balances regularly to identify discrepancies, prevent financial discrepancies, and keep trust accounts in compliance. Securing these funds is a powerful indicator of a firm’s forward-thinking management.

While it may seem like extra paperwork, properly managing 1099s ensures your records are accurate and helps you avoid tax issues. Employing professional accounting services can transform a law firm’s financial management. These experts offer specialized knowledge tailored to the legal sector. They handle complex financial tasks with precision and efficiency.

CARET Legal Workflows lets your team have the space to collaborate, align, and coordinate together. These problems can harm a company’s profitability and reputation without qualified support. That’s why small organizations prefer outsourcing such services rather than managing their financial operations in-house. The next major undertaking is merging the fundamental accounting backbones, which requires a strategic approach to data consolidation and software harmonisation. The firm’s “approved systems” may be locked down, monitored, MFA-protected, and backed up.

If you have employees, you’ll have to pay https://www.natchezdemocrat.com/sponsored-content/the-importance-of-professional-bookkeeping-for-law-firms-4435f7a6 Federal Insurance Contributions Act (FICA). Federal insurance contributions consist of the social security and Medicare taxes you withhold from your employee’s pay and match with your own contributions. You will also need to understand your obligations in regards to employment law and employment tax. This is especially important when it comes to paying mandatory disability or worker’s compensation insurance.

You can research this on your state government’s website, and consult with your CPA. If you’re going to hire employees, you will need to set up payroll. Gusto is an online service that automates a lot of the work involved in managing payroll and employee benefits.

For a deeper dive into these and other important benchmarks, see this guide to law firm financial metrics. Commingling is when a law firm mixes client funds with firm funds, either intentionally or by mistake. It’s a serious ethical violation that can result in bar sanctions, fines, and even disbarment. To avoid unintentional commingling, you must keep meticulous records, separate trust accounts, and regularly reconcile accounts.

NO144, Road No5, Krom 1 Phum 2. Sangkat Chrang Chamres1. Khan Ruusey Keo 12107. Phnom Penh. Kingdom of Cambodia