Whoa, this caught me. I’ve been watching prediction markets for years now, on and off. They trade information like a living thing and show hidden consensus signals. Initially I thought these probabilities were mostly noise, but then I started correlating spikes in volume with real-world events and realized how quickly markets incorporate new evidence when liquidity is there. On the surface outcome probabilities look like neat percentages, though actually they reflect a tangled mixture of trader beliefs, capital flows, and short-term noise that you need to parse carefully.

Seriously, trust no single metric. Volume surges can mean a conviction shift, or just noise. Look at order book depth and trade sizes together for quick context. My instinct said watch the timing too—news timestamps, timezone differences, and whether retail momentum or a few whales are driving the move, because that changes how much weight I assign to a probability. Something felt off about certain low-volume markets that still showed extreme probabilities, and that taught me to discount isolated bets.

Hmm, interesting signal. Sentiment indicators help, but they’re often lagging or noisy on their own. Watch social chatter, position concentration, and whether market makers widen spreads. Initially I thought social volume would reliably predict probability shifts, but then I realized that sometimes coordination and bots amplify narratives that don’t translate into sustained capital flows, producing temporary illusions of consensus. Actually, wait—let me rephrase that: social signals are a useful early-warning system only when corroborated by real money moving across the market, not just retweets or hot takes.

Here’s the thing. Liquidity matters far more than a headline number of trades on the surface. A thousand tiny trades don’t equal one large directional position in influence. On one hand high trading volume correlates with stronger signals, though actually it depends on distribution of that volume across traders, timing, and whether it’s contrarian fresh capital or recycled intraday activity. If you want to use volumes quantitatively, build short windows, weight recent trades, and flag suspicious clusters before letting probabilities move your portfolio.

Whoa, watch for spikes. A sudden spike is a red flag and a green flag simultaneously. Context again matters: are there correlated markets moving, or just one isolated contract? Sometimes arbitrageurs tighten probabilities across related markets, and sometimes traders herd into a single narrative, creating temporary divergences that revert as liquidity searches for parity across outcomes. I’m biased, but I prefer markets where multiple related contracts move in consonance—it’s less flashy, but often more reliable over time.

Really? Watch maker behavior. Market makers set spreads and can mute or amplify probability movements. If a maker withdraws liquidity, expect chop and strange fills for a while. On the other hand, steady narrow spreads with rising volume often indicate informed participation, though detecting ‘informed’ versus ‘technically driven’ requires cross-checks, like volume across related events and timing relative to external evidence. My trading notebook now flags these patterns automatically, but I also maintain a manual check because models sometimes overfit to weird short-lived dynamics that feel convincing but aren’t.

Hmm, somethin’ odd here. Sentiment is both qualitative and quantitative, so blend both approaches. Ask who is buying, why they’re buying, and what would make them sell. On one hand you can backtest strategies that react to rapid probability shifts, though actually those backtests often fail forward when market microstructure changes or when traders adapt and exploit naive rules. Initially I thought simple triggers would work forever, but live trading corrected that assumption quickly and compelled me to add noise filters and human review layers.

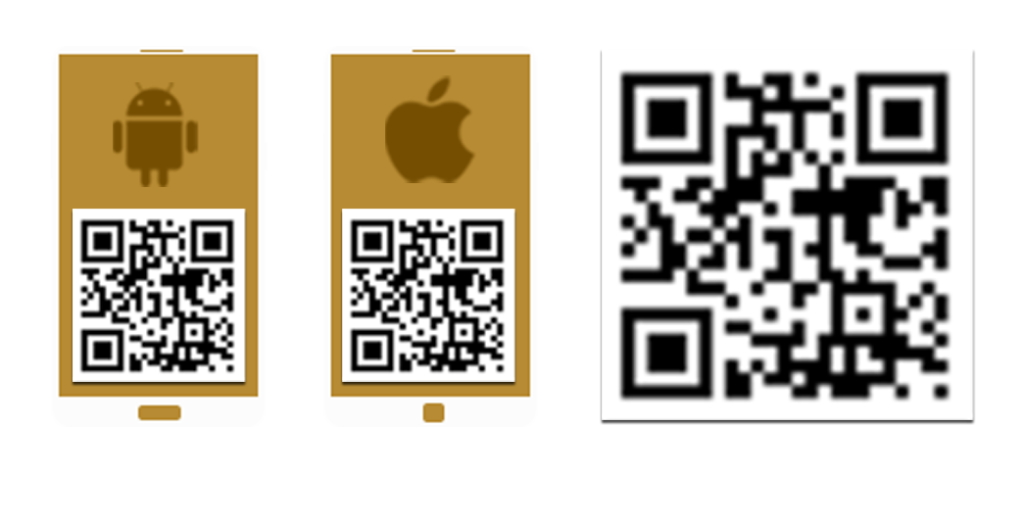

Okay, quick takeaway. Probabilities are signals, not certainties, and volume tells you how noisy that signal might be. Use sentiment as context, volume as conviction, and structure as your referee. If you want a place to practice reading these signals in a live market with diverse contracts and transparent probabilities, explore platforms that specialize in event trading—I’ve used several and I recommend visiting the polymarket official site when you’re checking options and onboarding, because it shows practical examples of these dynamics. I’ll be honest: nothing replaces doing the work, keeping a small real-money practice account, and learning to tolerate being wrong while you calibrate; it’s slow, messy, and very very educational.

Think of it as group belief, not certainty; a 70% implies substantial conviction but watch volume and related markets for confirmation. If volume is low, treat that 70% as fragile; if many related markets move too, that number likely reflects real information flow.

Not usually. Sentiment can kickstart a move, but sustained probability shifts require capital behind the story—real liquidity. So combine sentiment signals with volume checks and maker behavior before acting.

NO144, Road No5, Krom 1 Phum 2. Sangkat Chrang Chamres1. Khan Ruusey Keo 12107. Phnom Penh. Kingdom of Cambodia